1. Introduction

The digital economy is evolving rapidly, and with it, the way businesses manage payments. As consumers and companies increasingly turn to decentralised finance and blockchain-based solutions, cryptocurrency is emerging as a viable, efficient, and secure alternative to traditional payment methods. In 2025, crypto payments are no longer experimental, they’re becoming a practical tool for businesses aiming to stay competitive, reduce costs, and serve a global customer base.

This guide provides a comprehensive overview of how your business can start accepting crypto payments. From understanding the core concepts to choosing the right payment gateway and ensuring regulatory compliance, we’ll walk you through each step. Whether you’re a small online retailer or a multinational enterprise, platforms like Bitpace offer tools and infrastructure to integrate crypto payments seamlessly into your operations.

Why crypto payments matter in 2025

Cryptocurrencies have matured into credible financial instruments, driven by improvements in scalability, security, and user adoption. As blockchain technology becomes more integrated into global finance, businesses are beginning to leverage crypto payments not just for innovation but for efficiency. With more users preferring decentralised methods of payment, especially in regions with limited banking infrastructure, offering crypto options can boost your customer acquisition and retention in 2025.

Benefits for B2B and B2C businesses

Crypto payments are no longer exclusive to tech companies or early adopters. B2C brands use them to provide alternative checkout options and reduce cart abandonment, while B2B firms leverage the speed and cost-efficiency of crypto for international transactions. Instant settlement, minimal fees, and reduced currency conversion friction make cryptocurrency a strong asset for both segments.

This guide explains how crypto payments work, what businesses should consider before integration, and how to set up a secure and compliant system using Bitpace. You’ll also learn about the different types of cryptocurrencies, integration methods, security considerations, and key best practices for success.

2. Understanding crypto payments

Crypto payments refer to the use of digital assets, such as Bitcoin, Ethereum, or stablecoins, for purchasing goods and services. These payments are recorded on blockchain networks, which are decentralised and immutable ledgers that ensure the security and transparency of every transaction. Unlike credit card networks or bank transfers, crypto transactions occur directly between the buyer and the seller without intermediaries.

This reduces transaction times, minimises fees, and lowers the risk of chargebacks. For businesses, it means access to a wider audience and faster, more reliable cash flow.

Key differences from traditional payments

Unlike traditional payments, which rely on banks and card issuers, crypto payments eliminate intermediaries. This results in lower transaction fees, faster settlements (often within minutes), and irreversible transactions, greatly reducing fraud and chargebacks. Additionally, crypto does not require the same complex infrastructure, making it ideal for global and underbanked markets.

Types of crypto assets commonly used (e.g., stablecoins, BTC, ETH)

- Bitcoin (BTC): The first and most widely recognised decentralised crypto that investors could buy and sell on crypto exchanges.

- Ethereum (ETH): A versatile asset used widely in e-commerce and DeFi due to its smart contract functionality.

- Stablecoins (e.g., USDC): Pegged to fiat currencies, stablecoins provide price stability and are ideal for businesses seeking minimal exposure to market volatility.

Platforms like Bitpace support a wide range of cryptocurrencies, offering flexibility and ease of integration tailored to your business needs.

3. Why your business should start accepting crypto payments

Adopting crypto payments can transform your business operations and broaden your customer reach. Partnering with a platform like Bitpace ensures a smooth and efficient integration with your existing payment systems.

Benefits for businesses

Attract new customers

Accepting cryptocurrencies allows you to connect with a global, tech-savvy audience. With millions of crypto users around the world, and the number growing each day, offering digital payment options enables your business to tap into a rapidly expanding market that prefers transacting in crypto.

Reduce transaction costs

Crypto transactions generally come with fees between 1% and 2%, significantly lower than traditional credit card processing fees. Bitpace offers highly competitive rates, helping your business boost its margins by cutting down on operational costs.

Accelerate payment settlements

Enjoy faster access to your funds. Unlike traditional banking systems, which can take several days for international payments to clear, crypto transactions are typically settled within minutes, improving your cash flow and overall efficiency.

Eliminate chargeback risks

Since crypto transactions are irreversible, your business is protected against chargebacks and associated fraud. This added security strengthens your financial stability and reduces potential losses.

Strengthen your brand image

Showcase your business as innovative and forward-thinking by offering crypto payment options. This modern approach appeals to tech-driven customers and sets your brand apart in a competitive landscape, enhancing trust and loyalty.

Enable borderless transactions

Cryptocurrencies make it easy to sell internationally without worrying about currency exchange fees or banking intermediaries. By facilitating direct, cross-border transactions, your business can expand its global reach effortlessly.

By integrating Bitpace’s advanced crypto payment gateway, you can take full advantage of these benefits and stay ahead in today’s dynamic digital economy.

4. How crypto payments work

To successfully incorporate crypto payments into your business, it’s important to understand how they function. This section outlines the essential elements and processes involved.

What is crypto?

Crypto refers to a digital or virtual form of money secured by cryptographic methods. Unlike conventional currencies, it operates independently of central authorities. Cryptocurrencies rely on blockchain technology to maintain security and transparency.

Businesses typically store cryptocurrencies in digital wallets, which can either be ‘hot’ (connected to the internet) or ‘cold’ (offline), depending on their security preferences. By accepting cryptocurrencies, businesses enable direct peer-to-peer transactions, bypassing banks and other intermediaries, which reduces both transaction fees and settlement times.

What is blockchain?

Blockchain serves as the underlying technology behind cryptocurrencies, functioning as a decentralised ledger that records all transactions across a distributed network. Each transaction is bundled into a block, which is then linked to the previous ones, forming an unalterable chain in sequential order. Once recorded, the information in a block cannot be changed, ensuring transparency and data integrity.

The decentralised design removes the need for a central authority, enhancing security and minimising fraud risks. For businesses, blockchain provides a verifiable and tamper-proof record of transactions, simplifying processes like auditing and compliance.

Beyond financial services, blockchain technology is increasingly applied in areas such as supply chain management and smart contracts. By leveraging Bitpace’s blockchain-based payment gateway, your transactions remain secure, transparent, and efficiently organised.

5. How a crypto payment gateway works

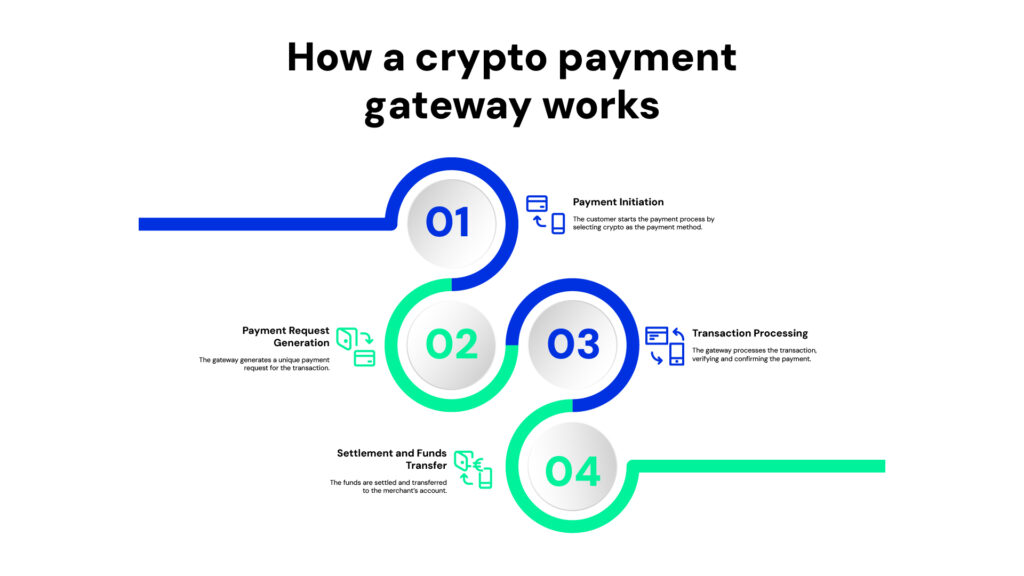

A crypto payment gateway acts as a bridge, enabling secure and streamlined transactions between your business and your customers. Here’s a breakdown of how the process unfolds:

- Payment initiation

At checkout, customers select crypto as their preferred payment method. They are then directed to the Bitpace payment gateway, either through an integrated checkout page or via an external payment link.

- Payment request generation

Bitpace generates a detailed payment request, allowing customers to view the exact amount owed in crypto. A unique wallet address is assigned for each transaction, often accompanied by a QR code to make scanning and payment quick and easy.

- Transaction processing

Customers send the designated crypto amount to the provided wallet address. Bitpace securely records, encrypts, and transmits the transaction details to your server, while displaying a confirmation message once the payment is completed.

- Settlement and funds transfer

After the transaction is verified on the blockchain, Bitpace immediately converts the crypto into your chosen fiat currency. With Bitpace, the conversion price is locked for 30 minutes to avoid any market fluctuations that may change the price.

Key benefits and processes

- Global reach and lower fees: Bitpace cuts out intermediaries, reducing transaction costs compared to traditional processors.

- Instant conversion: Crypto payments are quickly exchanged into fiat, so you don’t need to manage digital assets yourself.

- Protection against chargebacks: Transactions are irreversible, reducing exposure to fraud and chargeback disputes.

- Regulatory compliance: Bitpace keeps your operations aligned with evolving crypto regulations, ensuring secure and lawful processing.

By integrating Bitpace’s crypto payment gateway, your business can diversify its payment options, strengthen transaction security, and optimise financial workflows with ease.

6. How to integrate a crypto payment gateway into your business?

Choosing a crypto payment gateway

Begin by choosing a provider that matches your business needs, considering factors like supported cryptocurrencies, fee structures, and integration options. Bitpace is a strong contender, offering a user-friendly platform, competitive fees, and broad crypto support. Look for features such as API flexibility, easy-to-use payment buttons, and plugins for major e-commerce systems to ensure smooth integration with your existing setup.

Integration options

API integration: Take advantage of Bitpace’s comprehensive API documentation to customise your crypto payment processes. This method offers full control, allowing you to design a payment flow that perfectly fits your business operations.

E-commerce plugins: Install Bitpace’s official plugins, which are compatible with leading platforms like OpenCart and WooCommerce. These plugins simplify the process and allow your online store to start accepting multiple cryptocurrencies seamlessly.

Email and direct link invoicing: Send crypto payment requests directly via email or a link, a practical solution for businesses without a website or for managing B2B transactions efficiently.

Steps to get started

- Choose your crypto payment gateway:

Opt for Bitpace to benefit from real-time transaction tracking, automatic fiat conversion, and strong security protocols. - Register and set up your account:

Sign up on Bitpace and complete the necessary KYC verification. The process is straightforward, ensuring you gain quick access to services. - Integrate the payment gateway:

Implement Bitpace’s API, payment buttons, or e-commerce plugins to add crypto payment options to your online store or point-of-sale system. Their detailed documentation and dedicated support team make integration easy. - Configure your checkout:

Customise the checkout process to include crypto payment options. With Bitpace, you can also enable automatic conversion to fiat currencies to provide more stability in transactions. - Stay compliant with regulations:

Make sure your business complies with applicable crypto laws. Bitpace supports compliance with features like real-time transaction monitoring and built-in KYC/AML tools.

Additional considerations

- Low fees and greater efficiency:

Bitpace keeps transaction costs low and eliminates chargebacks and rolling reserves, helping to maximise your profitability. - Real-time monitoring and regulatory compliance:

Use Bitpace’s live dashboard to track payments in real-time and maintain full compliance with KYC and AML regulations, protecting your business from potential legal risks.

By following these steps and leveraging Bitpace’s complete range of services, you can successfully integrate a crypto payment gateway into your business, offering secure, fast, and reliable cryptocurrency transactions.

7. Essential factors to consider when accepting crypto payments

Regulatory compliance

Crypto regulations vary across regions and continue to evolve. Seeking guidance from legal professionals can help clarify the necessary steps and ensure your business remains compliant with the latest regulatory requirements.

Integrating crypto into the checkout experience

Adding crypto payment options to your checkout process involves connecting them to your payment gateway or point-of-sale system. Payment processors like Bitpace offer seamless integration with popular e-commerce platforms, enabling businesses to accept crypto without disrupting the user experience.

Managing the payment process

- Sending payments: Open your wallet app, choose “Send Payment,” input the amount and the recipient’s address (or scan their QR code), and confirm the transaction.

- Receiving payments: Access the wallet app, select “Receive Payment,” and share your public wallet address with the sender to receive funds.

Fees and conveniences

While crypto processors such as Bitpace charge transaction fees, they offer major advantages like instant settlements and support for a variety of digital assets.

| Processor | Fees | Settlement time |

| Bitpace | Low | Near Instant |

| Traditional | Higher | 1-3+ business days |

Point of sale and hardware

If you operate a physical store, it’s important to integrate your point-of-sale hardware with your crypto payment provider. Display clear signage to inform customers that you accept crypto at checkout.

Security and risk management

Given the inherent volatility and security challenges of crypto, it’s critical to use a secure payment system. Ensure that your gateway implements advanced security protocols. Additionally, adopt strategies to manage price fluctuations and minimise fraud risks, protecting both your business and your customers.

By considering these critical aspects, you can successfully integrate crypto payments into your operations, using Bitpace’s reliable solutions to maintain compliance and manage risks effectively.

8. Getting started with Bitpace crypto payment gateway

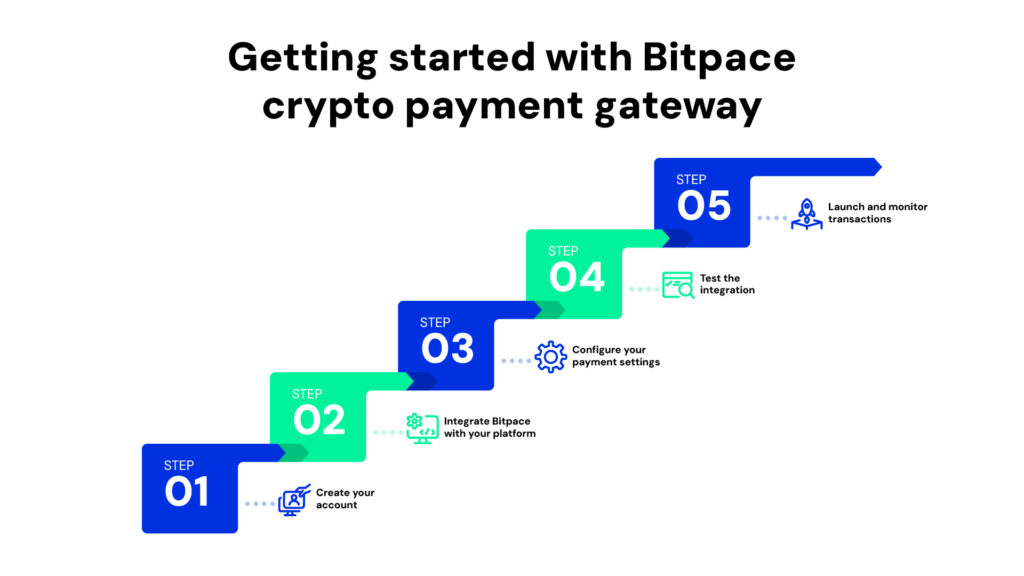

Integrating Bitpace’s crypto payment gateway into your business can streamline the acceptance of crypto transactions, boosting your operational efficiency. Here’s how you can set up Bitpace with ease:

Step 1: Create your account

Begin by registering for an account on the Bitpace website. You’ll need to provide essential business details to meet Know Your Business (KYB) verification standards. Completing this verification ensures that your account complies with regulatory requirements, paving the way for secure transactions.

Step 2: Integrate Bitpace with your platform

Bitpace offers multiple integration options to suit your business needs:

- E-commerce platforms: Install Bitpace’s plugins designed for platforms like OpenCart and WooCommerce. These plugins allow for quick and seamless integration, enabling customers to choose crypto as a payment option effortlessly.

- API integration: For businesses operating custom-built websites or apps, Bitpace offers a comprehensive API. This allows you to fully customise the integration, ensuring the payment gateway complements your site’s functionality and enhances the user experience.

- Payment links and invoicing: Create unique payment links for direct transactions. This flexible option is perfect for businesses without an online storefront or for managing B2B payments.

Step 3: Configure your payment settings

After integration, configure your payment settings to match your financial preferences:

- Select cryptocurrencies: Pick from a wide array of supported cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and stablecoins like USDC, to accommodate diverse customer preferences.

- Set settlement preferences: Decide whether you want to receive payments in cryptocurrency or have them automatically converted to fiat currencies like USD, GBP, or EUR. Opting for automatic conversion can help manage crypto market volatility and ensure stable revenue.

- Enhance security: Enable two-factor authentication and other available security options. Bitpace uses advanced encryption technologies to safeguard your transactions and sensitive business information.

Step 4: Test the integration

Before going live, take advantage of Bitpace’s sandbox environment to test the integration. Run several transactions to verify that everything works smoothly and troubleshoot any issues early on. Proper testing ensures a seamless customer experience once the payment gateway is live.

Step 5: Launch and monitor transactions

After successful testing, activate the Bitpace crypto payment gateway on your platform. Use Bitpace’s real-time dashboard to monitor all transactions, track payments, and generate detailed reports. This level of oversight allows for efficient payment management and quick resolution of any discrepancies.

By following these steps, you can successfully integrate Bitpace’s crypto payment gateway into your business, offering secure, flexible, and reliable cryptocurrency payment options.

9. Advanced Features and Custom Solutions

As your business grows, so do your operational needs. Bitpace offers a suite of advanced features and tailored services to ensure your crypto payment infrastructure evolves with you.

Auto-conversion: To manage market volatility, Bitpace offers automatic conversion of crypto payments into fiat currencies like USD, EUR, or GBP. This protects your revenue from price fluctuations and ensures you maintain stable cash flow without needing to monitor the market.

Customised workflows for enterprises: Large businesses often require more sophisticated tools to manage high-volume transactions. Bitpace supports customised workflows for invoicing, settlements, and payment routing, giving enterprise clients the flexibility to integrate crypto payments into complex financial systems.

Dedicated account managers: For high-volume merchants and enterprise users, Bitpace provides dedicated account managers who offer personalised support, ongoing optimisation, and strategic insights to ensure your crypto payment system operates smoothly and delivers maximum value.

10. Best Practices for Crypto Payment Success

To ensure a seamless and sustainable crypto payment experience, businesses must go beyond integration. Implementing the following best practices will help you maximise success and avoid common pitfalls.

Educating your finance and operations teams: Ensure internal stakeholders understand how crypto payments work, from transaction processing to accounting implications. Bitpace provides onboarding support and resources to bring your team up to speed quickly.

Communicating with your customers: Clearly explain your crypto payment options at checkout and in your FAQs. Transparency builds trust and encourages customers to try new payment methods. Bitpace’s hosted checkout pages and branded payment flows make this easier.

Handling support and refunds: While crypto payments are irreversible, you should establish clear refund policies. Bitpace enables manual refund processing to selected wallet addresses, allowing you to retain customer goodwill when needed.

Managing crypto volatility: Settle payments in fiat automatically to avoid price swings, or choose to retain crypto if you want exposure to asset appreciation. Bitpace’s auto-conversion and real-time pricing tools give you full control.

Analysing payment data to drive growth: Use Bitpace’s analytics dashboard to monitor transaction volumes, customer behaviour, and conversion rates. Data-driven insights help you optimise payment flows and better understand how crypto is impacting your bottom line.

11. Future of Crypto Payments: What to Expect Beyond 2025

The crypto payments space is evolving quickly. Looking ahead, businesses that embrace innovation will be better positioned to thrive in a decentralised financial ecosystem.

Increasing institutional adoption

Banks, fintechs, and multinational firms are adopting blockchain-based payment solutions. As institutional players enter the space, crypto payments will become even more accessible and trustworthy for merchants.

Expansion of stablecoin use

Stablecoins like USDC and EURC are gaining ground as reliable payment instruments. Their low volatility and fiat peg make them ideal for daily transactions, payroll, and international settlements.

On-chain settlement and programmable payments

Smart contracts will enable payments that execute automatically when predefined conditions are met, streamlining escrow, subscriptions, royalties, and more.

Greater regulatory clarity and interoperability

As global frameworks emerge, crypto payment compliance will become more straightforward. Cross-chain interoperability will also enhance flexibility, allowing businesses to accept a wider range of digital assets without complexity.

12. Conclusion

Accepting crypto payments is no longer just a trend; it’s a smart, strategic move for forward-thinking businesses. From lower fees and faster settlement to global reach and enhanced brand perception, the benefits are real and measurable.

Bitpace provides everything you need to get started: secure infrastructure, seamless integration, automatic fiat conversion, and expert support. Whether you’re a startup or a large enterprise, Bitpace equips you with the tools to thrive in a digital-first economy.

Start accepting crypto payments today with Bitpace, your trusted partner in modern finance.

![How to Accept Crypto Payments [2025 Guide]](https://www.bitpace.com/blog/wp-content/uploads/2025/06/How-to-Accept-Crypto-Payments-2025-Guide.png)

![How to Accept Crypto Payments [2025 Guide]](https://www.bitpace.com/blog/wp-content/uploads/2025/06/how-to-accept-crypto-payments-2025-guide-bitpace-1024x576.jpg)